Construction Insurance in the Wake of a Recession

It’s a collective nostalgia…photographs with guys, dirty-faced hanging out on high beams; the hard hats, the grit…the pride. For decades, construction in the United States showed the world that our relatively new nation was strong and resilient. This was our American way. But over the years, the industry revealed its volatility, see-sawing in tune with a fluctuating financial market. In 2008, the housing recession brought businesses to the brink of collapse, testing owners on their ability to keep workers in their jobs while making good on their contracts. Construction insurance did little to combat the downturn as labor shortages, overhead, and taxes relentlessly chipped away at profits.

Fast forward a few years, and the reality of the situation was driven home. In March of 2006, the total monthly valuation for all construction in the U.S. (both public and private) was $1.2 trillion. That’s trillion with a “T.” And in July of 2014, valuations came up considerably shorter, at $981 billion (Source: Software Advice, Construction Software, The Great Recession’s Impact on the Construction Industry).

Luckily, the see-saw is still in motion.

Construction is on the rebound, essentially reliving its former glory of erecting skyscrapers, homes, gas stations and storefronts. Construction has again regained its foothold, with companies reexamining their investment strategies in the ubiquitous brick and mortar industry.

The proof is in the numbers.

In Houston, new construction spending is expected to climb from $9.7 billion to $14.2 billion in 2016, and will hover around $14 billion through 2019 (Source: HBJ, These Sectors Will Lead Houston’s Construction Industry in 2015). The Bayou City is pulling through.

We should also extend a nod to Dallas-Fort Worth, which enjoyed $17.8 billion in new project starts in 2015, 19% more than the year before.

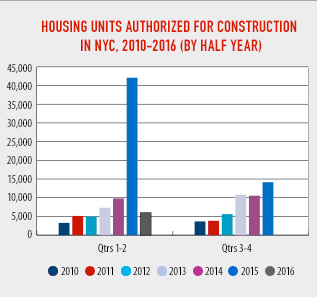

New York is leading the pack--A report released in early 2016 by Dodge Data & Analytics ranks the the Big Apple as both the largest and fastest-growing metro area in the nation for construction, with $35 billion in new starts during 2015, a 66% increase over 2014.

Bottom line, construction is again contributing to a thriving U.S. economy, shaking off the dust of poor banking decisions and subprime disasters.

But we’d be remiss if we didn’t mention the possibility that construction’s renewed claim to fame may not last as risks in construction and land development still loom.

So what can we learn from our recent past? Lost contracts, operational risks, the environmental impact, increased cost, business interruption…how can business owners temper and mitigate profit loss when the market again turns on its head? What can we say of hidden or unanticipated risks that might go uncovered?

Construction insurance written under a captive insurance company might be the answer. Here, we’ll discuss the specific ways forming your own property & casualty insurance company (a captive), can address risks while providing strategic direction to your financial plan year-over-year, despite losses. We’ll also touch upon operational and regulatory risks impacting the middle market, and how businesses can stand clear.

The Problem with Commercial Construction Insurance

While workers contend with the physical demands of the job, business owners take on an equally pressing burden, mitigating risks that are numerous and multifarious. From the initial design, to scheduling, equipment commissioning, project management, and more, business owners in construction are expected to be the point person in ensuring projects go as planned and remain on budget.

No matter how adept, owners know that inherent risks will remain present throughout the life of a project. Risks such as labor shortages can wreak havoc on the project’s economic viability.

In the commercial marketplace, builders risk and construction insurance is available to indemnify against damage to buildings while they're under construction.

But what of underlying pipes, tunnels, cracks in foundations, dewatering systems maintenance, and other related exposures? Typically, an insurance underwriter will add an “endorsement” or “rider” to the policy, which excludes coverage for risks considered “business exposures.” This puts insureds in a precarious position—they can either buy additional layers of coverage, usually at premium rates, or take on risks themselves. Most contractors will buy the extra insurance (if even available) in order to remain compliant with safety and governmental regulations. More coverage would be needed for general liability, business owner’s insurance and workers’ compensation. There’s home builder’s insurance, developer’s insurance, and even categories for welders and masonry.

For large projects, an owner-controlled insurance program, or (OCIP) may be put into place—this is an insurance policy held by a property owner during the construction or renovation of a property. It covers all liability and loss (also subject to exclusions). With owner-controlled insurance programs, the owner relinquishes control over coverages purchased by the general contractor and the potential impairment of insurance coverage limits on the general contractor’s insurance. The owner also has significant exposure to losses not covered under the general contractor’s insurance and could be subjected to complicated and expensive claims handling procedures (Source: wrapinsurance.com).

The truth is that gaps in insurance policies can leave construction businesses vulnerable to financial hardship. Business owners must also acknowledge that taxes and other fees will undoubtedly stack up.

Filling Gaps in Construction Insurance Coverage

According to Travelers’ business risk index for companies across the U.S., businesses in the construction industry cited employee/labor risks as their biggest concern. The shared fear among middle market contractors is that they would have to quickly find workers if a large contractor came into town, luring their best employees away. This rings especially true for executive leadership; the decision-makers…the people who win business. In general, an employee shortage typically leads to extended construction durations and cost overruns. At that point, the economic viability comes into question. Gaps in coverage also have the potential to slow down production and push costs skyward.

Business owners who choose to self-insure through a captive insurance company can fund losses that a) may not be covered under their existing business risk insurance or OCIP policies and b) may be completely unavailable by traditional means.

At its core, a captive is an insurance company that has been specifically established to insure the risks of an affiliated or “parent” business. There are over 6,000 captives in operation around the globe and the industry is growing fast. In the U.S., more state regulators are realizing that middle market organizations are seeking alternative means to manage risk and promote financial efficiency.

At its core, a captive is an insurance company that has been specifically established to insure the risks of an affiliated or “parent” business. There are over 6,000 captives in operation around the globe and the industry is growing fast. In the U.S., more state regulators are realizing that middle market organizations are seeking alternative means to manage risk and promote financial efficiency.

States such as Delaware, Texas, and Tennessee have passed new captive legislation or have improved upon existing regulatory requirements. Considering the inherent risks in construction, business owners and their advisors can leverage captives to combat exposures in a more comprehensive way.

Middle market business owners who form their own captives can leverage both primary and ancillary advantages, such as the ability to cover deductibles and policy exclusions on conventional policies. When regulatory changes take effect, a business owner may want to write special risk coverage under their captive, which can protect them against compliance expenses and ensuing business interruption that may result. And when key employees jump ship, they can use their captives to fund losses that may arise.

In plain English, captives are a powerful risk management and planning tool when designed and executed properly.

Other sample construction insurance coverages that can be written under a captive include:

- Equipment Breakdown/Engine Repair

- Errors and Omissions

- Legal Expense Reimbursement

- Pollution Liability

- Damage to Geophysical Resources

- Loss of a Major Customer

- Labor Relations Risk

- Loss of Major B2B Relationship

- Lost Bid Development Costs

- Merger Failure Cost Reimbursement

- Special Risk: OCIP Policy – Gap policy providing coverage which is excluded on a GC’s OCIP program.

Construction is a tough business. With risks abound, there are many moving parts that need to be addressed by the end of a project. Contractors might even have hidden risks that aren’t top of mind. This is why a feasibility isn’t only helpful, but essential to your risk management plan.

A captive manger or management company with in-house expertise should come on-site to assess risks. The successful design, implementation, and administration of a captive is ultimately dependent on this initial step, as over-the-phone interviews rarely result in a full and accurate assessment of exposures (and subsequent premium levels).

The first step toward forming a captive is to partner with a captive management firm with the expertise required to handle all aspects of the planning.

Filling in gaps in insurance coverage, especially in construction, is fundamental in staving off unnecessary financial blunders; the kind of faux pas that can derail a contracting business when losses become overwhelming.

The Benefits of Captive Insurance

One thing to keep to in mind is that risk mitigation should be approached proactively. Business owners have the opportunity to combat risk with a one-two punch: conventional construction insurance in conjunction with a captive.

It’s a remarkably smart way to keep businesses afloat in an industry that has traditionally been caught in the crosshairs of changing market conditions. It’s a way to get in front of increasing employee benefit costs. It’s a way to head off equipment breakdown and other risks inherent in your business.

Some of the benefits of forming your own captive insurance company include:

- Coverages considered “uncommon” in the conventional marketplace

- Pre-funding of losses

- Efficient cash flow for business (premiums are taxed at a 0% Federal income tax rate)

- Secured loans back to the operating company

- Dividends in the case of a favorable loss experience

If you’re interested in learning more about captives, reach out to Capstone at WEB_TEL

Capstone Associated Services, Ltd. is the most integrated and largest outsourced provider of captive insurance services for the middle market. In association with The Feldman Law Firm LLP, Capstone administers property & casualty insurance companies that provide alternative risk financing services throughout the U.S. Now in its 18th year, we provide true turnkey services to a variety of industries, including construction.

We’re looking forward to hearing from you.

Image: Konstantin, Construction