You have a perfectly good insurance policy in place. You feel confident that if your business suffered a loss, you’d be able to bounce back in no time flat. But what happens when those losses fall outside your insurance policy? Do you keep paying high premiums for additional coverage? And what other benefits does your current coverage afford you in terms of business planning? Probably none!

In this article, we’ll give you some very specific reasons why forming a supplemental captive insurance company can be an essential part of your risk management and business plan. By forming a captive, you’ll be armed with more comprehensive coverage coupled with a sophisticated business planning tool. Read on!

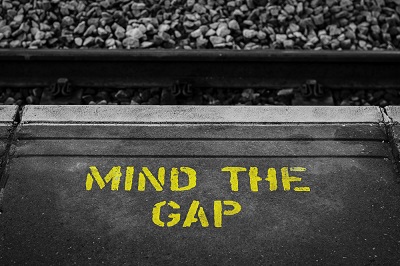

1) Gaps. Insurance has come a long way since its beginnings in ancient China and offsetting risks has never been easier. You probably have medical insurance policies, life insurance, and commercial coverages —workers’ compensation, pollution coverage, directors’ and officers’ liability and the like.

1) Gaps. Insurance has come a long way since its beginnings in ancient China and offsetting risks has never been easier. You probably have medical insurance policies, life insurance, and commercial coverages —workers’ compensation, pollution coverage, directors’ and officers’ liability and the like.

However, as a business owner you and your insurance broker have structured an insurance program the attempts to meet the needs of your operations by purchasing coverage provisions, limits, deductibles and exclusions. This structure is based upon decisions that reflect the level of risk aversion of each business owner. Those who are risk averse often buy a wide range of coverages at high premium levels that could easily be self- insured. Aggressive risk takers will often choose to go bare on critical coverage provisions or opt for very high deductibles. In either case, including a captive insurance company can improve the risk management program by providing broad coverage designed specifically for the business through an affiliated company.

A good example involves the decision to exclude pollution from policies, cover the more restrictive sudden and accidental pollution, or the broader seepage and pollution buyback. The decision involves choosing a smaller certain expense or a potentially larger uncertain expense. Captive insurance offers an attractive alternative.

The bottom line is that business owners who suffer catastrophic events may be liable for damages that are excluded from their conventional policies. With a captive, gaps in their existing insurance coverages can be mitigated with broader, more inclusive supplemental coverage. Policies written by the captive may address rare pollution incidents, supply chain risks, loss of services, equipment breakdown and more. Forming a captive insurance company makes sense for businesses with inherent operational risks, such as manufacturing, construction, transportation, healthcare and others.

2) Specialized Coverages. One of the main features of a captive insurance company is that coverages can be used to cover uncommon risks (take the aftermath of a serious viral outbreak such as SARS or Ebola). Through a captive insurance company, coverage can be designed to account for business interruption risks or the loss of key staff services that may occur as a result of a medical-related outbreak. Similarly, businesses that conduct work operations overseas may be faced with risks not covered by their conventional policies. Foreign risks such as kidnap and ransom are real possibilities for company employees who work in remote or dangerous areas. Some businesses may be primed for risk exposures such as government interference, nationalization and selective discrimination, embargo/blockages, unilateral termination of contracts by a government, and cancellation of authority to conduct business in a certain jurisdiction.

The Foreign Corrupt Practices Act (FCPA) makes bribery of foreign government officials a criminal offense that can involve significant fines and penalties. FCPA charges are costly to defend and usually involve complex international business practices. The grey area between making illegal payments and permissible "facilitation expenses" creates risk in many facets of international trade.

Industries that contend with changing regulatory environments must also take into account non-compliance risks. Industry regulations that are in constant flux, such as those found in the construction industry, could be devastating to business owners who fail to keep up. Coverages in the conventional marketplace do little to combat non-compliance issues.

All-in-all, most businesses are exposed to numerous risks that do not fit easily into standard policy forms and the decision to form a captive insurance company is one that could prevent financial burden for business owners. This sophisticated tool allows the business owner to go beyond these commodity type policies and customize a powerful risk management program.

3) Captives Can Improve Business Planning. Unlike conventional insurance coverages, captive insurance companies provide primary and ancillary benefits to businesses. These include risk coverage, the opportunity to loan retained earnings back to affiliated operating company from the captive during favorable loss conditions, and federal tax incentives. Insurance needs are met with comprehensive coverage and in the event that premium revenue exceeds claims, owners benefit from the profits of their own insurance company.

Financial advisors, CPAs, and insurance professionals who speak to their clients about forming captive insurance companies can position themselves as a knowledgeable advisor and boost confidence with their mid-market business clients.

4) Captive Insurance Companies are Highly Regulated. Captive insurance companies are actual property & casualty companies, legally established to insure the risks of their related businesses. Thus, they are regulated by an insurance commissioner of a U.S. state or foreign jurisdiction, i.e. a captive domicile. The domicile ensures that captives remain compliant with regulatory changes, tax laws, and other provisions. Most experienced domiciles offer operating flexibility, regulatory compliance, and a progressive legislative environment. Onshore domiciles such Delaware and offshore domiciles, such as Anguilla can offer mid-market businesses the support and oversight they need to operate according to federal and state regulations.

4) Captive Insurance Companies are Highly Regulated. Captive insurance companies are actual property & casualty companies, legally established to insure the risks of their related businesses. Thus, they are regulated by an insurance commissioner of a U.S. state or foreign jurisdiction, i.e. a captive domicile. The domicile ensures that captives remain compliant with regulatory changes, tax laws, and other provisions. Most experienced domiciles offer operating flexibility, regulatory compliance, and a progressive legislative environment. Onshore domiciles such Delaware and offshore domiciles, such as Anguilla can offer mid-market businesses the support and oversight they need to operate according to federal and state regulations.

5) More Control Over the Claims Process. Natural disasters such as hurricanes Katrina and Sandy put a spotlight on some conventional insurers that were slow to respond to claims. The federal government tried to lend a hand in providing housing for residents displaced by the storms, but the FEMA response was considered a failure by most. Business interruption losses were widely felt as business owners fought to re-establish some modicum of normality.

These problems might have been avoided with the help of coverage provided by a captive. Denials based on the bad-faith claims processes of some commercial insurers are eliminated when you own your own insurance company. When a loss occurs, you have the power to file a covered claim and receive payment without undue delays. Businesses that form captive insurance companies are resilient because they have planned for losses and they control the process.